Perceptive Capital Insights

Quarterly Update - Q3, 2023

Perceptive investors and friends of the firm,

We trust this message finds you in good health and high spirits. It is our privilege to bring you our latest insights into the ever-evolving world of digital assets. Whether you've been with us since the beginning or are just joining our community, we're delighted to have you on board. Our aim is to keep you informed and engaged as we explore how advancements in this technology revolutionize business, finance, communication, culture, and beyond.

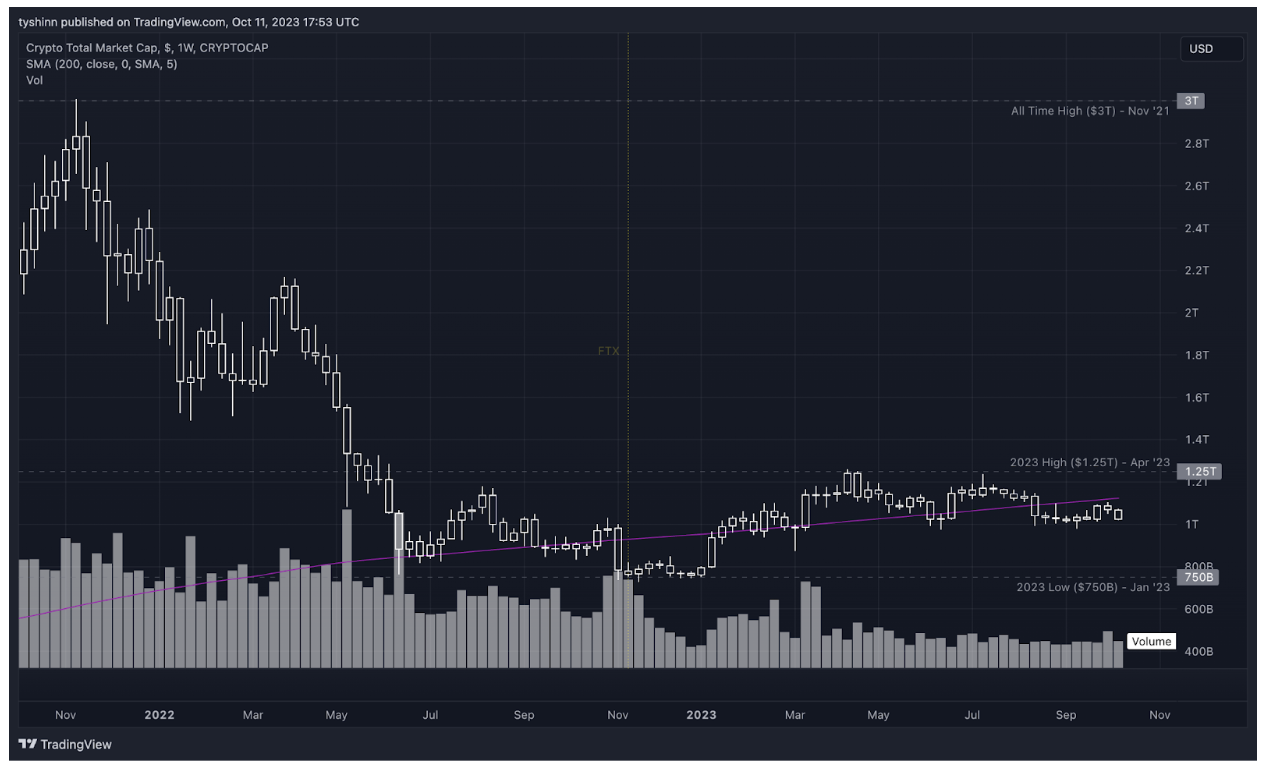

Crypto’s global market cap (chart below) ended the third quarter at around $1 Trillion, down roughly 9% over the quarter but still up meaningfully (35%+) since the start of the year. Trading volumes were flat in Q2 and Q3, as investor appetite for the asset class remains muted compared to historical norms. Bitcoin and ether displayed their diversification potential as their performance and correlations contrasted sharply with traditional assets, something which may become increasingly important to many investors should the equity landscape deteriorate. And despite BTC and ETH prices ultimately notching negative price action over the quarter (BTC -12%, ETH -14%) there were substantial positive industry developments worth highlighting.

Payments giant PayPal announced its launch of a U.S. dollar-backed Stablecoin, allowing PayPal’s customers to transfer, send peer-to-peer, fund purchases, and convert other currencies using the coin. Bi-partisian support for the industry re-emerged as representatives from both parties in the U.S. collaborated over industry regulation and urged the SEC to approve spot Bitcoin ETFs. And while it’s likely that the SEC delays approval for as long as possible, Gensler threw the industry a bone by approving Ethereum Futures ETFs, a necessary, but less-than-ideal, financial product for traditional market participants. Cleanup from various 2022 bankruptcies and implosions progressed (e.g. FTX, Celsius), and while Venture Capital funding was down in Q3, numerous funds announced meaningful raises, evidence that investors are still committed to deploying cash into the space. In our last update, we noted the growing U.S. regulatory offensive, highlighting SEC complaints against Binance and Coinbase, as well as some judicial victories against regulators. That trend continued over Q3, with additional SEC challenges matched by wins for the crypto industry in the courts [1, 2].

Looking forward, we continue to think that a combination of a bitcoin spot ETF (we expect Q1, ‘24), the Bitcoin halving (est. April, ‘24), and a growing fear of fiat currency debasement amidst ballooning government debt payments are the likeliest catalysts for crypto adoption and positive momentum in the coming months. Should a bitcoin spot ETF gain approval, we’d expect an ether spot ETF to quickly follow. Simplistically, spot ETF approvals should open the gates to new traditional market investor inflows, lifting prices. ETF approvals followed by the bitcoin halving and the Fed perhaps cutting rates or loosening policy, would coalesce as strong buying pressure in the crypto markets. There are, of course, a number of risks to this narrative (e.g. macro, negative regulatory rulings, etc.). And so far net inflows to crypto markets have failed to materialize as the market has struggled to break free from macro concerns or find footing with a new use case or application that captures broad user appeal (excluding stablecoins).

On the topic of stablecoins, PayPal’s mentioned entry into the stablecoin arena is significant. The issuer is Paxos, a trust company, meaning the reserve assets are bankruptcy-remote, and will be overseen by NYDFS. The stablecoin, pyUSD, is issued as an ERC-20 token on the Ethereum blockchain, meaning all network transfers of this coin incur gas fees, paid in ether to network validators (and stakers), or burned as part of EIP1559, reducing total ether supply. Consider the potential impact should PayPal’s product become popular with PayPal’s active user base of over 435 million. For framing, Ethereum’s 30 day average active userbase is less than 1 million – should even 1% of PayPal’s users onboard to crypto, it would result in substantially more DeFi users. PayPal embracing an open blockchain, and Ethereum gaining PayPal as a consumer, both seem noteworthy.

While bear market builders keep building, we remain on watch for emergent decentralized applications (dApps) that capture significant product-market fit. The novel attempts we witnessed over the quarter (e.g. FriendTech, StarsArena) were unable to achieve sustainable attention from the market. Until such a product materializes and captures mainstream attention in developed markets, the 2023 adoption trends suggest that the most meaningful adoption progress has been bifurcated between grassroots crypto adoption in lower middle income countries (e.g. India, Nigeria, Ukraine – a cohort containing 40% of global population) and institutional adoption from high income countries (e.g. USA, UK, Saudi Arabia). As we’ve discussed previously, broad institutional adoption depends heavily on clear regulatory outcomes, which edge closer after each court ruling or legislation advances.

On the macro front, the latest pressure on global assets seems to stem from the US bond market and the Federal Reserve’s higher-for-longer narrative. During the mid-September meeting, the central bank signaled one additional hike later this year, and any subsequent rate cuts might occur more slowly than anticipated. The Fed’s refreshed guidance led to an increase in bond yields and a stronger Dollar. The combination of rising bond yields and higher oil prices appeared to weigh on equity markets and most other risk assets - although much of crypto ended the month of September with positive gains (CCI30 Index +2.90%). The S&P 500 lost almost -5% in September, led lower by segments tied to the health of the US economy: homebuilders, industrials, and retail, while the Nasdaq lost almost -6%.

Bitcoin was largely immune to the drawdown in traditional assets, and outperformed most other large-cap cryptocurrencies. While trading volume continued to decline during the month, a variety of Bitcoin’s on-chain metrics improved: funded addresses, active addresses, and transaction counts all increased. Given the progress toward a spot bitcoin ETF in late August, it’s possible that the pickup in on-chain activity represented positioning by new investors ahead of possible regulatory approval. bitcoin may also have been supported by news that the trustee overseeing defunct crypto exchange Mt Gox will delay creditor repayments until October 2024, which reduces any looming selling pressure. The estate holds approximately 138,000 bitcoin, currently valued above $3.5 billion.

Turning toward the Ethereum ecosystem, Layer 2s continue to supercharge Ethereum’s scalability, making the network cheaper and faster for users. The August launch of BASE – a Layer 2 blockchain on Ethereum – by Coinbase signals a substantial endorsement of the Ethereum ecosystem and opens up distribution of decentralized applications to 100 million Coinbase users. Meanwhile, the largest Layer 2 blockchains on Ethereum, Optimism and Arbitrum, have surpassed large competitor Layer 1s like Solana in Total Value Locked (TVL). If Layer 2s continue their trajectory they will solidify Ethereum as the leading Layer 1 blockchain.

In the realm of DeFi, the fund’s positioning in LINK was a clear outperformer for the quarter, up 30%. Part of this performance came from Chainlink’s release of the Cross-Chain Interoperability Protocol (CCIP), a global standard for cross-chain communication. CCIP establishes a universal connection between public and private blockchains so that arbitrary data, tokens, or instructions alongside tokens (i.e. programmability) can be sent between chains. Interoperability is an important challenge that blockchains need to solve. We’ve likened development of crypto ecosystems to the development of the internet many times before, and Chainlink’s release of the CCIP standard could be an important step forward for standardizing communication across blockchains, in the same way that HyperText Transfer Protocol (HTTP), File Transfer Protocol (FTP), User Datagram Protocol/Internet Protocol (UDP/IP) and Transmission Control Protocol/Internet Protocol (TCP/IP), are standards for communication and transmission over the internet.

Over the quarter we also saw a number of major crypto theses have positive developments. In the realm of Real World Assets (RWAs), Hong Kong is considering tokenizing stocks, hinting at a more tokenized financial future. The story is one of a growing body of examples of RWAs, like stocks, migrating or converting into “tokens” that live on-chain. In the Non-Fungible Token (NFT) space, Pudgy Penguins, a popular project, is launching a toy collection in Walmart, reflecting the NFT industry's crossover potential with traditional retail. In the last crypto bull market, NFTs proved an unexpected gateway to adoption for new users. While the NFT market has since cooled significantly, the sector presents a unique opportunity to onboard a different consumer segment. Staying true to its primary purpose, the bitcoin supply held by long-term holders recorded an all-time high, signaling that fundamental belief in the asset remains strong, despite broader market challenges and volatility.

As a concluding thought - we remind our readers that while the broader financial landscape remains uncertain, the prospect of crypto market's growth and the asset class’ unique diversification properties remain. As the technology continues to be tested and challenged, a hardening of foundational, resilient use cases will occur. To that end, we continue to advocate for patience and strategic long-term positioning.

*Note - while editing this quarterly piece, news broke of Israel’s declaration of war. This conflict is terrible news and we hope that peace will be reached swiftly. Our responsibility is to be stewards of our investor’s capital and to evaluate how these events could affect financial markets. WIth that in mind, it’s of little surprise that “hard assets” (e.g. gold) and oil have historically proven safe bets during times of war. However, near-term price action can vary from the longer-term results. As an example, gold initially sold off (-13%) during the Yom Kipper war in 1973, and subsequently rallied over 100% the following year. As such, we are evaluating strategies based on a range of potential outcomes for modern hard assets like bitcoin.

As always, we’re honored to have you with us, and are available for any follow-up questions or conversations. We thank you for your continued trust and support.

Your Team at Perceptive