Q3 Market Pulse

November 2nd, 2022

During the third quarter of 2022 digital assets displayed some encouraging signs of resiliency and lightened volatility, which is particularly noteworthy given the confluence of macroeconomic challenges and unusual turbulence in the equity markets. At times, Crypto held steady while established technology behemoths like Amazon and Apple experienced intraday price swings of +/- 10-20%, causing many to question the experienced correlation with tech indices. But, while we view this as progress, we also maintain that any “de-coupling” from tech and risk equity markets remains distant. Over the quarter, total crypto market capitalization increased an ever-so-slight 4.6%, to approximately $900 billion, far below the market’s peak last November of about $3 trillion. And while developed markets across the globe grapple with dislocations resulting from elevated inflation and interest rates, crypto builders are heads down, building, institutions are getting louder on their commitment to the space, fundamentals are displaying promising growth and adoptions statistics, and the beat goes on.

Below we’ll cover:

- The Institutions Are Coming Here

- What Happened With That Whole "Merge" Thing?

- NFTs In A Metaverse of Their Own

- On The Horizon

The Institutions Are Coming Here

In stark contrast to previous crypto bear cycles that saw institutions flee (e.g. 2018), those who began tip-toeing into the digital asset ecosystem in 2020 have since deepened their involvement and commitment to the space via investments and infrastructure development. We believe that this time the key differentiator is the utility and functionality of the applications currently in operation. The on-chain data is now real, quantifiable and trending in the right direction, whereas in earlier cycles the bet was based on theoretical promises. For example, examining one of the more tranquil corners of the ecosystem, fiat-backed stablecoins like USDC and USDT (Tether), the on-chain data shows more than a 10-fold increase in circulating supply since 2021. Consider that in 2021 USDC had a circulating supply of approximately $4 billion, impressive, but that supply is now $43+ billion, while Tether supply stands at an even larger $70 billion. Recall that for each USDC or USDT token that’s issued there is a 1 for 1 backing of US Dollar reserves held in US depository banks and short-term US government securities. Leaving aside the alternative stablecoin options (lesser-known fiat- backed stables, partially-backed stables, algorithmic stables, etc.), the rapid growth of USDC and USDT alone highlights an impressive migration of US dollars onto blockchain networks. Another highlight; While there are a number of challenger networks to Ethereum, the original smart contract platform continues to achieve higher counts in addresses/wallets with a balance greater than 1 ETH, showing that support for the network remains strong.

Meanwhile, network activity on the Ethereum mainnet (i.e. Layer 1) combined with network activity on its Layer 2 scaling solutions like Arbitrum, Optimism, etc. also reaches new highs. We expect Layer 2s to increasingly dominate the blockspace of the Ethereum mainnet, while new users will be directly on-boarded to Layer 2s, enjoying cheaper transaction costs, and faster transaction speeds (millions of transactions per second) all while maintaining the safety and security of the Ethereum baselayer.

On the other hand, when it comes to prices, well, we’re still firmly experiencing the woes of a bear market. However, the price action hasn’t stopped big name institutions from commenting on the newfound strategic importance of cryptocurrencies and digital assets. Jenny Johnson, President and CEO of Franklin Templeton ($1.4 trillion AUM) recently commented on her firm’s commitment to blockchain, investing in digital assets, and offering related products to the firm’s clients. Meanwhile, financial institutional giant Fidelity announced they will begin offering clients the ability to invest in Ether (ETH), making it the second cryptocurrency investment option, alongside Bitcoin (BTC) that’s available on their Digital Assets’ platform. Fidelity intends to offer a growing number of crypto investment options to service retail and institutional demand. The decision aligns with the results of their annual institutional survey of over 1,000 participants in which 74% said they plan on buying digital assets in the future. More broadly, this year’s survey showed a growing understanding and respect of blockchain technology and digital assets as an emerging asset class. BNY Mellon supports Fidelity’s conclusion in their own institutional survey, showing that 41% of institutions currently hold cryptocurrencies in their portfolios, with a further 15% planning to invest within the next two years. Even more illuminating is the response that, aside from cryptocurrencies, 91% of survey participants were interested in investing in tokenized/digital assets. The fact that 91% of survey participants even understand the term “tokenized assets” speaks to the education that traditional financial players have undergone. On the retail front, Mastercard unveiled a new program to offer clients the ability to buy and sell digital assets directly through their bank accounts. As some of the larger banks remain sidelined, Mastercard’s network includes thousands of bank partners across the globe, and this program widens the on-ramp for mainstream crypto adoption at the retail level. And while full scale adoption may still be years or even a decade away, we find these themes incredibly bullish for long term participation in the ecosystem, application development, growth, and revenue, at both the network and application levels.

Bottom line: The institutions are here, they’re educating themselves on the technology and the markets, and they’re sticking around despite the market sell-off or any ongoing price volatility. This is a validation of our thesis that institutions will serve as critical on-ramps for new entrants, as they continue to partner with experts and build robust infrastructure solutions, helping to evolve the ecosystem at large

What Happened With That Whole "Merge" Thing?

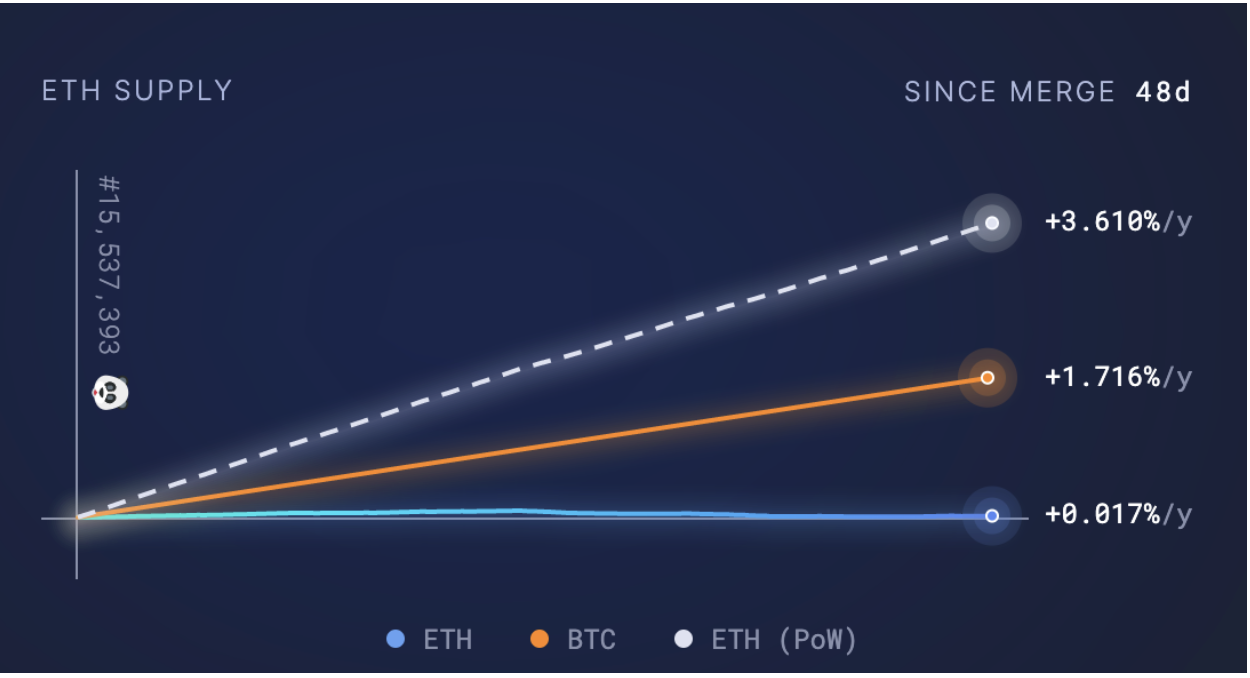

Undoubtedly, many institutions watched closely as Ethereum made its successful transition to a Proof of Stake (PoS) blockchain consensus model in September (the “Merge”). While we discussed many benefits to PoS in our last newsletter, the most widely understood benefit of the transition is the significant improvement in energy efficiency of PoS. The transition alleviates many institutional concerns around sustainability and potential environmental complications as they weigh their ESG (Environmental, Social and Governance) mandates. Another important change to highlight surrounds Ethereum’s new issuance schedule for creating new Ether. The issuance schedule is now a dynamic function, fluctuating based on network activity. Higher network activity results in more ETH “burned” and a lower net issuance/supply. Now, approximately 48 days after the Merge, new ETH issuance stands at +2,766 ETH, a marked (-99.5%) reduction in issuance compared to the old Proof of Work (PoW) issuance schedule. Under the PoW regime, new issuance over the same period would be +575,022 ETH. Further, as network activity increases or returns to levels seen earlier this year and during 2021, the net new supply is estimated to become negative, i.e. deflationary. The chart below shows the fall in Annual Issuance Rate from ~4% to ~0% after the Merge.

For the data curious, here is a link to monitor and compare Ethereum’s ETH issuance as Proof of Stake vs. Proof of Work in real time. You can also compare Bitcoin’s net new token issuance in comparison to Ethereum’s new regime.

NFTs In A Metaverse Of Their Own

In other crypto-related news, Non-Fungible Tokens (NFTs) continue to serve as an on-ramp to crypto for different types of users (e.g. art, gaming, social branding, and individualized contracts). The NFT landscape continues to gain momentum and create new use cases from blockchain technology. OpenSea, a popular NFT trading venue deployed on multiple blockchains (Ethereum, Polygon, Solana), has shown elevated average daily user volume throughout the bear market. The resiliency of activity is impressive given the distinct decrease in crypto trading volume witnessed on centralized exchanges (e.g. Coinbase, FTX, etc.). Also, mainstreet’s favorite game retailer, Gamestop, went live with their NFT marketplace. The platform is built in partnership with crypto company ImmutableX (Token: IMX), an Ethereum Layer 2 scaling solution focused on gaming. The aim of Gamestop’s new platform is to serve the gaming community by providing a marketplace for in-game assets, and create a system of real asset ownership across the gaming universe. This could have far-reaching implications for the gaming economy, creating a new type of labor system for earning/achieving in-game assets and their resale value or utility

On The Horizon

After today’s announcement from the Fed, signaling another 75bp rate hike, market prognosticators are focused on the new expected terminal fed funds rate being higher than previously anticipated. We strongly believe a Fed pivot is coming, just not yet, despite the spin we’ve been hearing from many media outlets. Taking Powell at his word in the close of his statement today “The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”. So until the job is done, or the Fed’s overnight repo market breaks, we think the equity markets will see more pain, there will be more dislocations in the funding and credit markets, and additional political capitulation before a Fed pivot could be tenable. That said, there is certainly some blood in the streets already; Meta (Facebook) is down ~75%, Amazon is down ~45%, the stock market is down 20%, some Fixed Income markets are having their worst year in recorded history, Bitcoin is down ~70% and Ethereum is down ~68%, but we still believe there is more to come. Nevertheless, and considering our long term adoption thesis has so far proved true, history should view these drawdowns as buying opportunities. For that reason, we remain positioned defensively, cautiously scalp trading, hunting for value and buying depressed DeFi assets that we view as having strong fundamentals with narratives of upcoming releases or upgrades that could refocus investor attention. There are some crypto events on the horizon, such as the Ethereum Shanghai update, but in general the market seems to be missing the narrative juice that fuels investor attention and higher prices. So we are holding steady, staying thoughtful where we believe we have advantages or can beat the market, and are all hands on deck as we wait for the tides to turn.

As always, we remain available for deeper conversations surrounding portfolio positioning, performance attribution, market and event context, or anything else crypto-related. Please do not hesitate to reach out to us should you have any further questions.

We wish all of you a very Happy Thanksgiving and holiday season ahead.

Your Team at Perceptive