Decoding Recent Digital Asset Headlines

June 16th, 2022

Access any mainstream media outlet today and macroeconomic concerns abound. While investors attempt to navigate volatile financial markets during a period of relative uncertainty, there has been a disproportionate amount of negative headlines surrounding digital assets. As always, some articles are written with more journalistic fidelity or market understanding than others. So, below we attempt to explain some of the recent crypto market events or headlines that you may have seen. It’s important to try to cut through the noise or click-bait and stay focused on the long term prospects of this transformative, albeit volatile asset class. As always, your team at Perceptive Capital eats, sleeps and breathes this industry, so please excuse any unrecognizable jargon in our writeup below and feel free to reach out for additional clarity, education or to discuss any of the topics in depth.

Below we’ll cover:

The Collapse of Terra Luna’s Algorithmic Stablecoin (UST)

Ethereum’s Upgrade: The “Merge”

Celsius’ Overextension & Staked Ether (stETH) : Ether (ETH) Price Divergence

Perceptive’s Outlook

The Collapse of Terra Luna’s Algorithmic Stablecoin (UST)

Terra Luna’s implosion in May marks the single biggest collapse in crypto’s 14-year history. At the time of its demise, the Terra ecosystem’s “algorithmic stablecoin”, named UST, had grown to become the 3rd largest stablecoin with $18B+ in circulation. Let’s dive into what created the exponential growth and ultimate downfall of what many considered a crypto protocol Cinderella story.

The Terra blockchain’s native asset, LUNA, was directly linked to the issuance of the network’s de facto algorithmic stablecoin, UST (Note: UST is not the same as a similarly named stablecoin, Tether USD or USDT). Unlike other variations of stablecoins such as U.S. Dollar Coin (USDC), that are fully backed 1:1 with cash and short-dated U.S. government obligations, algorithmic stablecoins like UST attempt to maintain a 1:1 peg to $USD without being collateralized. If you are unfamiliar with the various flavors of stablecoins we highly recommend reading this breakdown by our friend Haseeb Qureshi.

At a high level, the Luna-UST dynamic included incentive mechanisms between Terra’s native asset, Luna, and the UST stablecoin. These incentives encouraged the market to maintain the UST:$USD, 1:1 peg. As 1 UST token was “minted” (created), an equivalent $1 in the LUNA token was “burned” (removed from supply), and vice versa. As UST traded below $1, market participants (namely arbitrageurs) were incentivized to burn UST and mint LUNA for a discount. Similarly, as UST traded above $1, market speculators could burn LUNA and mint UST tokens capturing a premium to $USD. In theory, rational market actors would continuously push and pull UST to the 1:1 peg with $USD.

Ultimately, the UST algorithmic stablecoin system was undercollateralized, which may have improved capital efficiency compared to other stablecoins, but introduced new vulnerabilities. One such vulnerability was the risk of a “bank run”, whereby market confidence in the incentive structure could be lost, and mass redemptions could cause existential risk to the system. Unlike fully-collateralized stablecoins such as USDC, or over–collateralized stablecoins such as Maker’s DAI, Luna’s UST was ultimately supported by the market’s demand for Terra’s native token, LUNA, which itself was linked to the growth and success of UST. Despite enthusiasm from much of the crypto community, including a rabid fanbase of “Lunatics”, and CEOs of major firms tattooing their dedication to Luna, it was a fallible cycle of self-support. Perceptive was fortunate to have avoided the vast majority of the Terra ecosystem. As Ali often said, “Terra Luna is a stablecoin masquerading as a blockchain.”

Fears about the LUNA - UST dynamic amplified, and on May 7th the system experienced its first liquidity shock. Initially, a large trade of 85mm UST was swapped for USDC on Curve, a decentralized exchange protocol that facilitates the exchange of similar assets such as stablecoins. This 85mm trade was enough to spook other UST holders, who subsequently began exiting their own UST positions. In general, asset pools on Curve target a ratio of 50:50 between assets, but on May 7th the ratio shifted as far as 77:23. In an attempt to normalize the ratio, the Luna Foundation Guard (LFG), a group dedicated to the Terra Luna ecosystem, injected $1.5B of reserve funds into the Curve pool. Their efforts were futile, panic ensued as UST investors raced for the exits. Massive capital outflows began and the price of LUNA continued to crater – ultimately, faith in the Terra Luna ecosystem could not be restored.

Eventually the Curve pool reached an unsustainable imbalance, around 98:2, and the ecosystem saw as much of 85% of liquidity withdrawn. Simultaneously the burning of UST tokens and minting of LUNA tokens effectively caused hyperinflation in LUNA, printing millions of LUNA each valued at $0.01, down over 99% from the month prior. There would be no going back, zero became the new algorithmic peg, and the greatest collapse in crypto history happened in the blink of an eye. Tens of billions were lost, a downfall larger than the implosion of Bear Stearns, and irreparable damage was done to Terra and more importantly to the validity of the entire crypto industry. This moment will surely serve as a blackeye for crypto’s reputation and may likely draw some negative, unproductive attention from regulators. Innovation is necessary for progress, and while there have been (and likely will continue to be) many attempts at algorithmic stablecoins, failures of this magnitude leave retail and institutions disillusioned and can impede user adoption. Yet, at the end of the day, this is an unfortunate speed bump (or car wreck) on the highway to a better financial future.

Elsewhere in the world of stablecoins, and shortly after the Luna debacle, there were renewed fears over the Tether USDT stablecoin peg. As USDT often comes under scrutiny for failing to provide complete transparency into the assets collateralizing USDT. But, as has happened countless times, USDT only briefly drifted from its 1:1 peg before quickly returning to stability.

Ethereum’s Upgrade: The “Merge”

The development roadmap for the Ethereum blockchain includes a variety of upgrades that will make the network more scalable, more secure, and more sustainable. Some of these upgrades have been envisioned since the origination of the network and have been worked on for years, by multiple teams across the Ethereum ecosystem. The major upgrades constitute what is known as ETH 2.0, and may take years to complete. Arguably the biggest upgrade, and certainly the most telegraphed, is Ethereum’s transition from a Proof of Work (PoW) consensus mechanism, like Bitcoin’s, to a Proof of Stake (PoS) consensus mechanism. This upgrade is referred to as The Merge.

Rather than the energy-intensive mining process used in the PoW method, PoS secures the blockchain network through a system of validators who have deposited, or staked, Ether and must then act truthfully and accurately else their stake be slashed. Validators earn fees for their service which can be thought of as yield. Currently, the miners processing Ethereum’s PoW chain and the validators processing Ethereum’s PoS chain (the Beacon Chain) are running in tandem, but ultimately all PoW infrastructure will be decommissioned as Ethereum migrates or merges fully to Proof of Stake (hence “The Merge”), currently slated for Q3/Q4.

Main improvements from The Merge include:

Sustainability/Energy Efficiency: PoS uses roughly 99% less energy than PoW consensus. Check out this visual:

Security: Requires a minimum of 16,384 validator nodes and will eventually be compatible with PC-equivalent hardware (easy decentralization). For security via decentralization, a robust network of nodes is best (bad example = Solana). Additionally a PoS network offers greater security from a network attack than a PoW network - see Vitalik’s blogpost on that here.

Decrease in Issuance: PoW miners will no longer receive a block reward/block subsidy, and the subsidy for ETH stakers/validators in the PoS consensus mechanism is much smaller (ETH issuance drops from 4.3% to 0.43%)

Once The Merge is completed, later in ETH 2.0, “sharding” can be introduced, whereby there are 64+ “shard” chains, allowing for up to 100,000 transactions per second on the Ethereum Mainnet (up from 30) and dropping fees by an estimated 80-100x.

The process of staking ETH as a validator is currently a one-way bridge in that, once staked, users are unable to withdraw their staked ETH until a period after The Merge. As a result, certain protocols like Lido, that run networks of ETH staking validators, tokenized their ETH deposits, one-for-one. By doing so, Lido is able to offer a tradeable, yield-generating version of ETH called stETH, or staked ETH. To facilitate the trading between ETH and stETH, Curve (mentioned earlier), created an stETH:ETH asset pool, in which users can swap between the two versions of Ether (staked or unstaked). This will be relevant in a moment…

Celsius Network’s Overextension & Staked Ether (stETH), Ether (ETH) Price Divergence

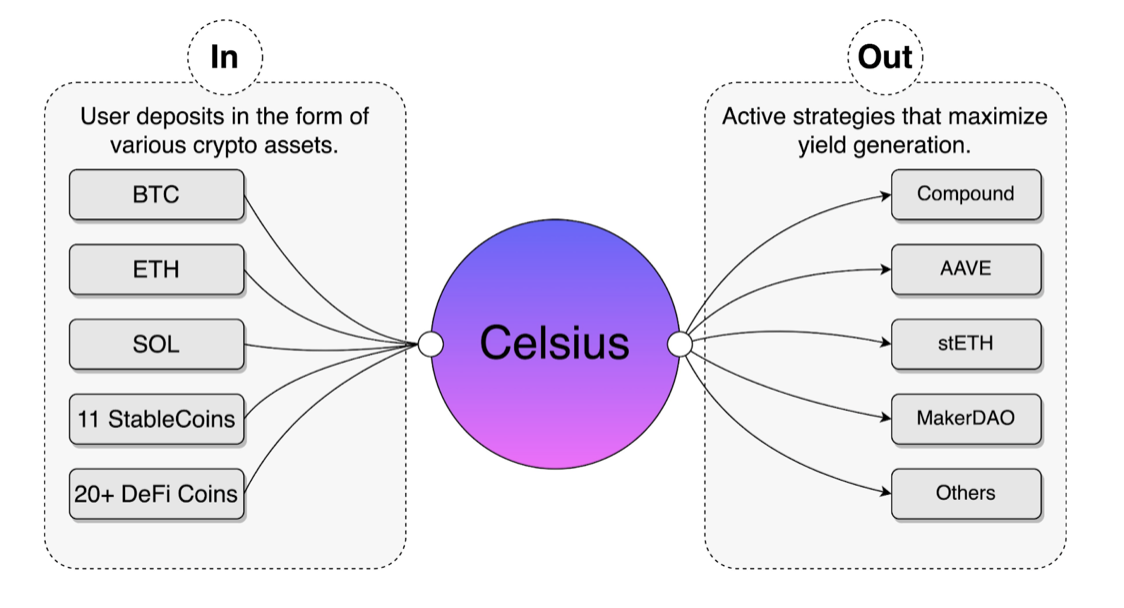

Celsius is a centralized cryptocurrency banking and lending platform. Celsius manages customers' deposits and promises a fixed return. Although they advertise their services like a bank account, the yield they pay customers is earned by effectively running a leveraged hedge fund, investing on-chain, originating loans to institutions and individuals, and keeping any spread as profits.

Celsius pledged user deposits as collateral on various decentralized lending and borrowing platforms such as Aave, borrowed against the collateral and amplified the yield earned on those assets. This strategy works great in a bull market, but it can be completely ruinous in a downturn. At Perceptive, we often cite the phrase that “Leverage is the fastest way to blow yourself up”. Now, Celsius is likely to have been highly overcollateralized, but cracks began to emerge following the fallout from Luna UST where it is believed that Celsius had approximately $500mm in exposure to UST when UST lost its peg.

Another large exposure on Celsius’ books was Lido’s staked Ether token, stETH (a synthetic asset representing ETH staked into Ethereum 2.0 validators). As stETH has grown in popularity, Aave, a permissionless borrowing and lending platform, voted to enable stETH as an eligible form of collateral for the platform, allowing users to borrow assets against their stETH deposit. This facilitated a new on-chain strategy of users recursively “levering up” the yield generated from holding stETH. The general premise requires depositing stETH, borrowing ETH against your collateral, swapping that ETH for stETH, and recursively depositing that stETH as additional collateral into Aave. This can be done only up until a point, as there is a diminishing borrowing capability, but it can be done recursively until a desired leveraged risk tolerance is attained. Many managed products sprouted up around this new capability – IndexCoop icETH, Galleon’s ETHMAXY, InstaDapp, and DefiSaver – which all offer variations of the same product and persistently monitor the positions so that users don’t have to, managing and reducing leverage when necessary. Through a combination of individual users and managed pools of money like Celsius, the Aave stETH pool quickly became one of their largest borrowing and lending markets, reaching over $2B in liquidity at peak, making it the third largest market on Aave.

Knowing that Celsius’ position in stETH was effectively leveraged, fear around Celcius’s potential liquidity issue arose. Celsius could find itself forced to sell its stETH holdings at a discount in order to satisfy any customer withdrawals. The potential inability of Celsius to fulfill customer redemption requests caused stETH to begin sliding from its peg in the stETH:ETH pool on Curve beginning around June 8th.

It was also thought to be possible that a nefarious actor could heavily short the stETH market while simultaneously “attacking” the Curve pool by removing a tremendous amount of stETH at a loss. In theory, that could reduce the price ratio of stETH:ETH to a degree that would cause cascading on-chain liquidations of any funds or investors with significantly leveraged stETH positions. The contagion of which could potentially force a market wide sell-off. In its current, live state, we’ve witnessed on-chain activity showing Celsius working to deleverage their positions and have learned of their hiring of restructuring lawyers as they face a potential bankruptcy.

It is important to recognize, however, that stETH operates under a drastically different mechanism than Luna and UST. UST was inexorably tied to the minting and burning of Luna while stETH is merely a representation of staked Ethereum. There is no link whatsoever between the issuance rate of Ethereum’s native asset ETH and the synthetic staked ETH, stETH. Ultimately Lido’s stETH will become redeemable 1:1 for ETH once withdrawals are enabled following The Merge. In a way, stETH can be likened to a short-duration bond on Ethereum’s switch to proof of stake. Any purchase of stETH at a price of less than 1 ETH is akin to purchasing a bond at a discount. Recall that stETH still earns staking rewards much like a bond pays a coupon, despite its price. And while some market participants remain fearful of these assets, barring a high degree of unmanaged leverage, long term-oriented investors with confidence in the successful completion of The Merge are effectively able to purchase future unlocked ETH at a discount. For these reasons we have a high degree of confidence that stETH will stabilize after the chaos and find price equilibrium based on the market’s expectation on timing for the completion of The Merge.

Perceptive’s Outlook

There is a lot of information to digest, from both within and outside of the crypto ecosystem. And while correlation with technology stocks and the equity market generally remains high, there are idiosyncratic elements and events within the digital asset landscape that can push or pull prices in one direction or another. Perceptive’s Flagship Fund has been fortunate to have avoided much of the market sell-off in June, after de-risking the portfolio considerably following a very challenging month in May. This isn’t the first “crypto winter” we’ve experienced and it’s unlikely to be the last. Digital assets have consistently proven to be cyclical with recognizable ebbs and flows. While this is perhaps the first time the industry has grappled with the woes of global financial instability, a looming recession, creeping inflation and the highest interest rate hikes since 1994, the underlying thesis hasn’t changed. In fact we continue to see fundamental support for the industry; Record adoption and new participants from across the wealth spectrum, a growing number and size of investment funds are announced every month, human capital continues to migrate from traditional jobs into Web 3.0, and innovative solutions are found along the inevitable march to a decentralized, highly-efficient, permissionless global financial network. While some of the stories shared above might give rise to hesitation, consider the improvement upon transparency compared to that of financial crises in traditional markets. Users were able to monitor situations and other users’ positions (including institutions) in real-time using on-chain analytics and respond accordingly. Any on-chain sleuth with a Twitter account had the ability to identify and broadcast on-going events or potential vulnerabilities. That is incredibly powerful, and a significant advancement in human coordination and the flow of information.

In 2018 we witnessed a crypto winter that rocked investors and led many to question the viability of the asset class. Today, the robustness of the ecosystem and the evolved infrastructure makes such existential questions seem naive. Crypto is not going away. Risk assets will continue to struggle as interest rates rise and growth outlooks decline. But once the war on inflation begins to turn, risk assets, and predominantly crypto, will come roaring back with a momentum unrivaled by any other sector.

With humility, we believe that these are the moments where history will prove courage to be prudent. Focusing on dollar cost averaging into your investment, and decreasing your overall cost basis, could very well prove to be a similar opportunity as it was in 2018. The market is on fire or on sale depending on your perspective. Despite asset prices diverging from their perceived fundamental values, what hasn’t changed is the world’s desire for a better financial system. DeFi and digital assets continue to work toward that future.

As always, we are honored to have you on board with us and we remain available for follow-up conversations at your request.

Your Team at Perceptive