Perceptive Capital Insights

End of Year Update - 2023

Perceptive investors and friends of the firm,

Welcome to 2024! We hope this message finds you in good health and high spirits. It is our privilege to bring you our latest insights into the ever-evolving world of digital assets. Whether you've been with us since the beginning or are just joining our community, we're delighted to have you on board. Our aim is to keep you informed and engaged as we explore the crypto market and the technological advancements that stand to revolutionize business, finance, communication, culture, and beyond.

The Year at a Glance

Reckonings

2024: The Year Ahead & Predictions

Our Team’s Future

The Year at a Glance

2023 was another volatile year for crypto and for our team, but ultimately the markets notched considerable gains. The FTX bankruptcy in November ‘22 appears to have marked the bottom of the current cycle, after the total crypto market cap fell almost 80% from all-time-highs (~$3 billion), reached just a year prior. Markets came out swinging in January ‘23, and the year would prove to be volatile, puzzling, combative, but ultimately productive. Mired by recent industry failures, fraudsters and scams, the tone in Washington pivoted to animosity, spearheaded by Senator Elizabeth Warren’s Anti-Crypto Army and SEC Chairman Gary Gensler’s hostile approach to regulation by enforcement. But the legal system proved to be an unexpected ally to the industry, serving justice to bad actors or overreaching agencies, and slowly untangling an array of bankruptcies. Early in the year our team suffered a major loss after our partner, Jamis’ tragic accident. Reeling from his absence, and anticipating heightened risk of macro turmoil, we positioned the fund with a defensive tilt, maintaining an outsized allocation to cash and stablecoin strategies. As the markets marched on, we eased back into some active bets and new trading strategies, which gained momentum throughout the year, and achieved healthy outperformance in November and December.

Now, a spot Bitcoin ETF is imminent, the Bitcoin halving is ~100 days away, and the market expects Fed rate cuts around that same time. Bitcoin should do well with this backdrop, and if history is our guide, much of crypto will follow.

Crypto Total Market Cap ended 2023 around $1.72 trillion, up from $750 billion to start the year, but still down almost 45% from the all-time-high in November, 2021.

Reckonings

2023 was a year of reckonings. And for the most part, we can look back and be thankful for the justice served. The year was spent battling in courts, struggling with politicians and overreaching regulators, and fighting to reclaim the narrative after the failures of 2022. The SEC filed a host of complaints, but when they were unable to shakedown pre-trial settlements and had their days in court, they lost more than they won. They lost against Ripple, took a decisive loss in the Grayscale case, and are now facing well-capitalized opponents in their ongoing suits against Coinbase and Kraken. Gensler’s credibility and impartiality is in question, with acts seeking his removal from the SEC. And after seemingly exhausting all avenues to delay a spot Bitcoin ETF, Bloomberg analysts now put the odds of SEC approval at 90%. November elections will be important, but we think Gensler is unlikely to occupy his post for another term.

The next biggest loser of 2023 has got to be Sam Bankman Fried. He was found guilty of fraud, and should be jailed for a long, long time - no matter that his second trial was dropped. The FTX bankruptcy is slowly progressing, and despite the estate paying millions of dollars per day in legal fees, customer claims (like ours) have been trading around 70 cents on the dollar, up from 1-5 cents initially. Note: Performance of the FTX claim won’t be recognized until a sale is executed - we’re still valuing the claim at zero on our books.

Crypto’s largest centralized exchange, Binance, and its founder Changpen Zhao (CZ) faced their own retribution, settling over $4 billion in fines with CZ stepping down and agreeing to serve jail time - but he’s still one of the richest people on the planet. Each of the big players on 2022’s crypto bankruptcy list (Genesis, Celsius, 3AC, et. al.) made headway toward resolution and saw oustings of the people who screwed up. Like a burning of the crops, weeds have been removed, disease (read: unhealthy financial leverage) has kept from spreading, and pests have been controlled. Make no mistake, there are still plenty of bad actors, scammers and frauds in this industry, but we’re definitely in a healthier place than at the start of the year.

With respect to investor appetite for crypto, 2023 was a tough environment for fundraising. Many investors were left waiting for the other shoe to drop. And for the first time in a long time they made decent returns sitting on cash - the opportunity cost of earning ~5% in short-term bonds or high yield savings accounts kept a lot of investors sidelined. We see signs of that reversing in the year ahead, with announced fund raises, and venture capitalists anxious to deploy. We hope that industry participants have learned from last cycle’s mistakes to place a greater emphasis on due diligence and not slide into the temptation of speedy speculation. Else we fear there could be just as many spectacular blowups as there were in 2022 and cycles prior. That said, we do acknowledge that our industry is bent to “move fast and break things”, as innovation and discovery cycles occur faster than ever, so some amount of collapse and remodel is healthy. We also believe our industry is “growing up”, albeit painfully slowly. Perhaps as more rigorous institutions become more involved following spot ETFs, we’ll start to see more measured investment approaches affecting the mindset of mainstream crypto investing.

Bearish investors had their own type of reckoning in 2023. US markets confounded gloomy expectations for the year. Despite concerns around geopolitics, energy markets, China’s property crisis, or elevated interest rates breaking the economy, US equity markets are nearing all-time-highs and Treasury Secretary Janet Yellen declared victory in achieving a soft-landing. We hope she’s right, and that we skate by with just those few bank failures from March. On the flip-side, we’re sobered by the fact that yield curves often uninvert, and equity markets reach new highs just before falling off a recessionary cliff (Feb. ‘20, Oct. ‘07, Mar. ‘00, Jul. ‘90). Nevertheless, markets expect easing monetary policy in 2024 and unless inflation makes an encore performance, we’ll take our seat and enjoy the show.

2024: The Year Ahead & Predictions

The S&P ended the year up 24%, the Nasdaq composite up 43% led by the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla), and Gold up 13%. Bitcoin led the rally out of the crypto bear market, up 155%, with Ethereum up 91%, and the DeFi Pulse Index up 81%. Very few anticipated the monster year that 2023 would be for crypto or for traditional US equity markets. Looking back, if you expected the Nasdaq to be up 40+% on the year and nearing all time highs, Bitcoin’s 2023 performance/recovery makes more sense.

Top of mind for most investors entering 2024 are signs that policymakers have finished raising interest rates and are now debating the timing of cuts. This pivot in sentiment alone could help continue driving equity valuations higher. However, the consensus view on Wall Street is that we’ll see positive yet underwhelming gains in 2024. Crypto’s correlation to equities is inconsistent, but there are clear idiosyncratic drivers setting up what could be another banner year for the asset class.

As in cycles past, Bitcoin has led the rally from the lows. Ethereum may have been the quickest major crypto asset to recover, but Bitcoin’s steady climb higher pulled everything else with it. In previous cycles, as the bear market winds down, Bitcoin dominance tends to peak, and Bitcoin tends to lead. As in the 2019/2020 typical pattern of Bitcoin leading, Ethereum followed then overtook Bitcoin by the end of the year. As such, we predict Ethereum will outperform Bitcoin in 2024. That said, there are two major near-term Bitcoin events that will serve as a barometer for what to expect; the imminent approval of a Bitcoin spot ETF and the Bitcoin Halving.

There are eleven different financial entity sponsors racing to become the pre-eminent Bitcoin spot ETF. In the world of ETFs, the largest, most well-known fund tends to earn the lion’s share of fund flows. You can bet that BlackRock and others will do everything they can to pre-arrange subscriptions on day 1 in an attempt to evidence their product’s leadership.

This is a rare opportunity to be the leading provider for the mainstay product of an emerging asset class. It’s no wonder we’re seeing these sponsors engage in massive marketing campaigns to win public mindshare. Who doesn’t enjoy a return of “The Most Interesting Man in the World” campaign, or at least something that resembles it.

Regardless of who wins the “Cointucky Derby”, all of this ad spend is productive. And regardless of the volume of inflows on day 1, the Bitcoin spot ETFs will be historic. Other spot ETFs are likely to follow - we’ve already seen sponsors updating their applications for spot Ether ETFs. Whether initial net inflows are $500 million or $5 billion, we think $10 billion sitting in spot Bitcoin ETFs one year from approval date is plausible. And we expect that $10 billion figure to correspond with fresh all-time-highs, both in Bitcoin price and in total crypto market cap.

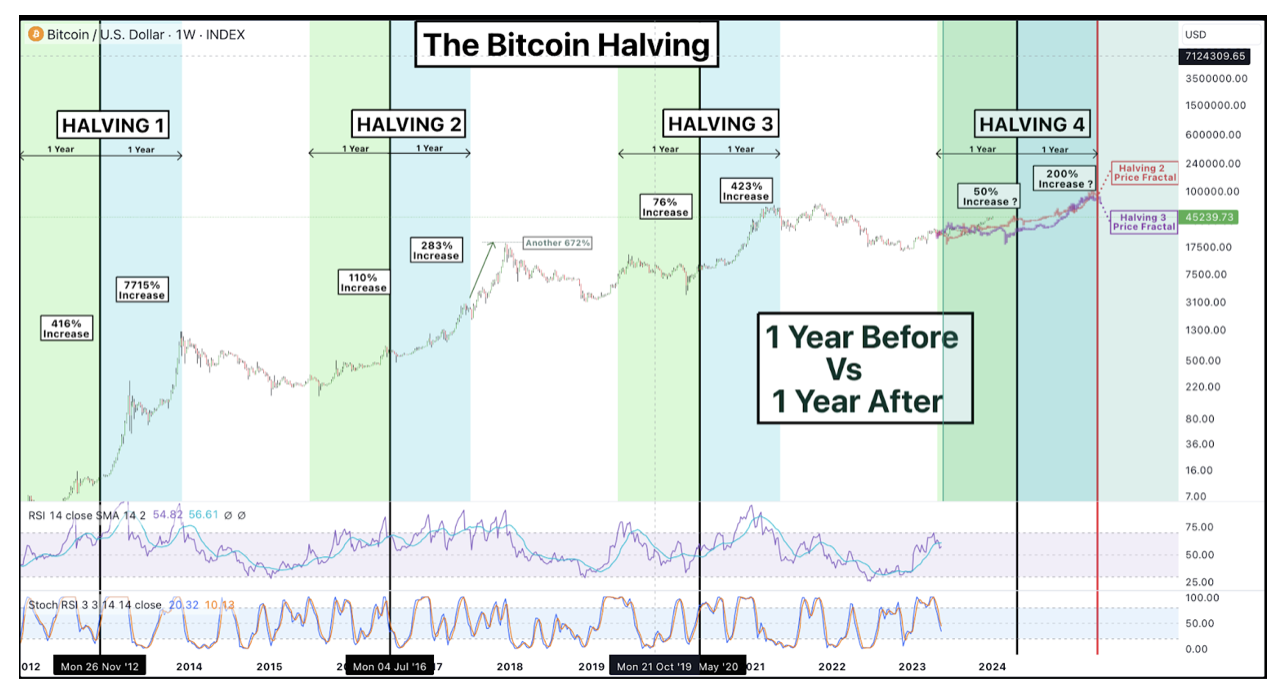

Amplifying the buzz around the Bitcoin ETFs is the synchronization with the Bitcoin Halving, that once-every-four-years moment when the Bitcoin network’s block reward/subsidy paid to Bitcoin miners is cut in half. This year we’ll see the Bitcoin network’s fourth Halving event, where the block reward will cut from 6.25 BTC, to 3.125 BTC per block. This will occur on Block # 840,000, expected in April. We won’t see another Bitcoin Halving until Block # 1,050,000, in 2028. While there’s plenty of debate around the importance of each Bitcoin Halving as it relates to price, miner profitability, network security, and more, there’s no doubt that each halving draws renewed interest and mindshare, reminding us all of the merits to a fixed-supply asset.

Should historical trends continue, many expect Bitcoin’s price (and broader crypto performance) to be a function of the Bitcoin Halving, anticipating a price run up for the year prior to, and immediately following the Halving. This would then be followed by a bear market and a subsequent recovery phase.

Bitcoin Halving impact analysis:

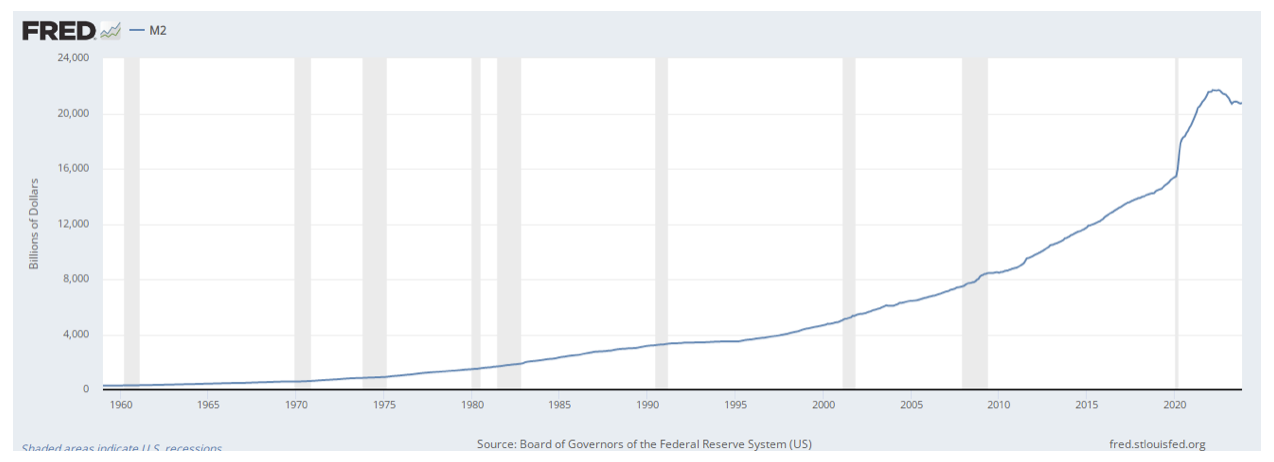

Relatedly, the Halving event always makes a fresh appeal to those concerned about governments endlessly debasing their fiat currencies.

US Money Supply (M2) hovering around $21 Trillion:

While Major Central Bank Money Supply (M2) is around $86 Trillion, near all time highs, and still increasing. Data includes the world's four major central banks (the United States, Europe, Japan, and China) to represent the market's liquidity level:

We believe the Bitcoin spot ETF will serve as a trojan horse. The game will change once this low-fee, simple, easy-to-understand product is inside the scope of traditional capital allocators. This is very different from existing options that offer expensive, complicated or derivatives-based exposure to Bitcoin’s price changes. ETFs offer daily liquidity, low-expense ratios, and avoid baked-in derivatives that have kept some investors at bay. Money managers will be incentivized to start up new conversations around Bitcoin and any crypto spot ETF that comes after it (the most likely being Ethereum). Investment mandates will be modified for institutional investors to consider an allocation to Bitcoin. And while institutional allocators may take time to include Bitcoin spot ETFs in their investment mandates, once approved, the genie is out of the bottle.

Next, we predict that an Ethereum spot ETF will also be approved by the end of 2024 or set for approval in early 2025 once the election cycle is completed. The CFTC and SEC have given various indications that Ethereum is considered a commodity rather than a security. Approving futures-based Ethereum ETFs in October was supportive of this conclusion. Furthermore, during the SEC lawsuit against Ripple in 2023, internal documents from previous SEC Division Director Bill Hinman were unsealed. In these documents, Bill Hinman and other SEC officials make statements indicating that neither Bitcoin or Ethereum would be considered securities under the current state of the law.

Aided by the hype around the Halving, we expect a cyclical rotation of capital from Bitcoin to other crypto assets. This will be measured by a decrease in Bitcoin market share dominance vs. the total crypto market cap. With current Bitcoin dominance around 55%, we expect this to peak following a potential wave of initial buying related to ETF flows and the halving, probably sometime in Q2, and then slowly retrace a majority of its climb from November, 2022, back towards 40%.

Ethereum should be one of the prime beneficiaries of a decline in Bitcoin dominance, along with whichever Ethereum-linked layer-2s, rollups, or sidechains that can gain adoption momentum. The two leading contenders are Arbitrum (ARB) and Optimism (OP). But rapid adoption of ZK proof cryptography and the launch of Coinbase’s own layer-2 solution, Base, mean there are a host of fast-growing, well-positioned contenders. Base is built using the Optimism technology stack, and success on Base is likely to also benefit Optimism. We’ve mentioned Base before, but as a reminder, given Base’s association with Coinbase and the customer data available to Coinbase, we predict that Base will become the leader of Anti Money Laundering (AML) / Know-Your-Client (KYC)-compliant blockchain activity. This would be particularly attractive for institutions looking for trading environments where all participants have been greenlit as legally compliant. For crypto-native investors, we expect a continuation of the trend of new users bypassing Bitcoin entirely and onboarding directly to the Ethereum ecosystem (including layer-2s, rollups, and sidechains) and alternative layer 1 smart contract platforms like Solana or Avalanche. We do not ascribe to a popular belief that Ethereum’s lackluster performance vs. Bitcoin and Solana in 2023 is evidence that Ethereum will be less desired in the future.

Many crypto analysts see Ethereum as “getting squeezed” by Bitcoin on one side, and Solana on the other. Bitcoin is seen as the best “hard-money” asset, and Solana is seen as a faster, cheaper chain for smart contracts. But we believe Ethereum’s endstate is to be the settlement layer for value and secure data over the internet. We liken Ethereum to an institutional asset. Ethereum is becoming more of a Business to Business (B2B) chain. It is the settlement layer for other lower latency, higher throughput, cheaper-to-use chains that can offer diverse and customized use cases (e.g. Base becoming an AML-compliant hub, or Immutable X (IMX) for gaming). Ultimately Ethereum is likely to get a spot ETF, the ongoing bankruptcy liquidations of Ethereum will end (e.g. Celisius selling thousands of Ethereum daily), and a growing need for reliable data security, we think will entrench Ethereum’s position as the leading layer 1 smart contract blockchain. Still, we continue to focus much of our attention on layer-2s and other blockchain scaling solutions as we believe the emergent category leaders will do well this cycle.

To that end, we predict a collective repositioning of many alternative layer-1 networks into Ethereum layer-2s or Ethereum-adjacent networks. Some teams and projects have already begun a migration back to the Ethereum ecosystem, deploying on Ethereum layer-2s, or Ethereum (EVM) compatible environments. Maintaining compatibility with Ethereum’s developer tools, and offering protocol composability is a significant advantage. The Ethereum ecosystem needs to solve an important fragmentation problem before seeing this trend accelerate, but it can be done with the help of new standards and unified infrastructure from the likes of Chainlink’s CCIP, Layer Zero, Axelar, Celestia, SKIP and others. NEAR protocol is a prime example of a recent repositioning. NEAR now offers a solution to Ethereum protocols' Data Availability (DA) needs. Rather than exist separately and contend with Ethereum, NEAR has shifted their strategy to achieve closer proximity with the Ethereum ecosystem. We’ll be watching to see if this trend continues.

Turning our attention to more application-specific use cases, price action in November and December started to validate some of our portfolio positioning with respect to DeFi application tokens (e.g. Uniswap, 1INCH, Osmosis, Aave). We’ve long contended that the incumbent DeFi apps stand to benefit from the lindy-effect. Provided the teams behind these applications continue to iterate and learn from the experiences of the collective, we see no reason why blue chip DeFi protocols like Uniswap, with their v4 and Uniswap X announcements, won’t benefit from brand loyalty, recognition and hardened security. Beyond the near term future with regulatory uncertainty in the U.S., we still believe that eventually these protocols will accrue significant revenue to token holders.

For many, last year forced an abrupt acknowledgement of the state of Artificial Intelligence (AI). OpenAI, Deep Mind and other industry leaders made headlines throughout the year. Some of the dilemmas facing that industry became a popular topic, and we witnessed companies attempt novel applications of blockchain technology to AI’s problems. Within crypto, it’s a popular thoughtthat AI’s need for provable-authenticity, decentralized data security, diverse computational energy and models blends nicely with blockchain tech. Whether or not blockchain tech is ready for AI use cases, the market capitalization of AI-related crypto assets witnessed a substantial increase over the year, soaring from $8 billion to just under $30 billion. This growth underscores the escalating enthusiasm and investment in AI technologies, and signals a significant shift toward AI-themed investments. We think it’s likely that crypto and AI will continue to find alignment in 2024, and there will be significant acquisitions or partnerships formed between reputable AI companies and blockchain-based teams. That said, we think that mainstream solutions are nowhere near, but this space will still be something to watch.

Additionally, we continue to think that Real World Assets (RWAs) will show up big in the years to come. Tokenization of traditional financial products caught steam in 2023, with the primary focus on having tokenized yield bearing debt instruments on-chain. Some companies, like Ondo finance, required AML/KYC compliance, while others found ways to avoid this, proof that there are still competing philosophies about how the future of a tokenized financial world should look. We expect to see a growing diversity of tokenized financial products in 2024. Zooming way out, we still hold our original fund thesis that blockchain will “eat” the financial market, and much of this is likely to happen via RWA tokenization.

Lastly, something that will perhaps aid corporations buying crypto assets is a recent rule change by the Financial Accounting Standards Board (FASB), which now allows crypto assets to be valued at fair values, with changes in fair value recognized in net income. This marks a significant shift from the previous model, where crypto assets were accounted for at cost less impairment. Said differently, crypto assets could previously only ever have their value marked down on a corporate balance sheet. This new standard should better reflect a corporation’s underlying financial position. As a result, we think this alleviates a prior concern for corporate financiers, and in the year ahead we predict we’ll see more companies joining the ranks of Tesla, Microstrategy and others by adding Bitcoin, Ethereum or other crypto assets to their balance sheets.

Our Team’s Future

The earliest conception of Perceptive Capital came from Jamis. For years, Jamis had been completely caught-up in the world of crypto, and had been searching for a way to allow others to benefit from his knowledge, connections, success, and vision for the industry. When he came to me and discussed a partnership, I was almost immediately enamored with the idea, and I knew from whom to seek advice. Top of that list was my former colleague and friend from Goldman, Ali, who had already successfully operated a crypto fund and was himself a recognized leader in the industry. As the three of us went into business and built Perceptive, the market climbed to new highs and we each settled into our roles for the firm. Unfortunately our timing marked a cycle peak, and many of our business contemporaries would not withstand the ensuing collapse. We endured, stayed agile, hunted for opportunities, and continued to find successes, some big and some small. We relied on our collective experiences of cycles past to navigate the road ahead.

Jamis has a wealth of experience, invaluable connections and insights that unfortunately remain unavailable to us for the time being. He continues to recover from his accident in the company of his loved ones in Salt Lake City. There’s no knowing what type of market intelligence, deal-flow, or myriad of expertise we are missing by not having Jamis’ mind actively applied to the management of the fund. As stewards of our investors’ capital, we have been seeking ways to plug some of the holes found in Jamis’ absence. We’ve outsourced some of our technology needs, we’ve leaned on our industry connections for additional market intelligence and support, we’ve formed new partnerships, and we continue to vet investing personnel in our search to hire additional talent. Our goal was always to grow the firm in terms of personnel and scope, unfortunately we’re having to do that under unexpected circumstances.

Jamis, Ali and I share a vision for the goal and investment strategy of our Flagship Fund. That vision is long-term and remains unchanged. The oscillations we make around prevailing market themes and positioning do not affect the ultimate goal of this platform and Jamis’ initial vision: build a fund that allows others to benefit alongside us, as we leverage our expertise within the asset class and endure for the long-term. If this technology is truly as revolutionary as we think it is, surviving, focusing on the long-term trends, and not getting too greedy or anxious will be the keys to our success.

I am proud of what Perceptive has accomplished in 2024. In many ways it felt as though the odds were stacked against us.

I’ll end with a concluding thought similar to our last newsletter - we remind our readers that while the broader financial landscape remains uncertain, the prospect of the crypto market's growth and the asset class’ unique advantages remain. The technology is still working toward being ready for “Prime Time”. There is still too much friction to onboarding the next billion users. But progress is being made. Times of exuberance tend to slow technological progress as it’s easy to get distracted. Last year was productive, both for builders and for those fighting to reclaim crypto’s narrative. The U.S. hasn’t been too welcoming, but European and Asian markets are laying the regulatory groundwork for serious growth and adoption in the years to come. As this technology continues to be tested and challenged, a hardening of foundational, resilient use cases will occur. To that end, we continue to advocate for patience and strategic long-term positioning.

As always, we’re honored to have you with us, and are available for any follow-up questions or conversations. We thank you for your continued trust and support.

Your Team at Perceptive

Ty Shinn, CFA

Managing Partner

Perceptive Capital

Disclaimer: The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, tax advice or investment recommendations. This presentation may contain forward-looking statements. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, or service of Perceptive Capital as well as any Perceptive Capital fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative of future results. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer.